Trading Strategies for Beginners

Jan 27, 2024 By Susan Kelly

Before you get caught up in a maze of charting and technical indicator terms, you should focus on the essentials of a basic Day trading method. Many traders make a mistake believing that you require a complex strategy to be successful in intraday trading; however, simpler strategies are the most effective. A strategy must be able to simplify the decision-making process. The size of trades, opening prices, and exit strategies become easier to understand when you look at them as part of the overall plan.

Momentum Trading

When using a strategy called momentum, investors will bet on the price of a stock that is increasing. Momentum stocks are scarce and difficult to find; just 10 out of 5,000 be able to meet the criteria on any particular day, according to Warrior Trading. Find these traits when you're trading stocks employing a strategy for trading momentum:

- A significant price change is triggered by catalysts like surprising growth in earnings, the discovery by a drug company of a novel treatment, or news that a larger corporation will buy a smaller firm

- Stock movements of 30 to 40 percent

- Smaller stocks are more liquid because of the smaller amount of shares outstanding. The flotation should be lower than 100 million shares

- Ideas or trends for trading momentum using tools such as StockTwits, a financial communication platform

To guard against too large losses, Warrior Trading sets a stop-loss order at the point of the price at which the stock first declines. The stop loss functions as insurance: You put to sell the stock at a specified price. If the stock price drops to certain levels, the shares will be transferred to you, safeguarding you from further losses.

Scalping Strategy

The concept behind scalping strategies is that even small wins could save an enormous amount of money in time. The scalper establishes the buy and sell levels and stays within these predetermined limits. The scalping technique is swift. It's not unusual for multiple trades to be executed in only a few minutes.

Scalping is among the most effective strategies for day trading for experienced traders who can make quick decisions and then act upon them without hesitation. The scalpers who adhere to this strategy have the discipline to immediately sell if they notice a drop in their price which means they can minimize losses. If you're often distracted and lack sharp concentration, this isn't your day trading strategy.

Pullback Trading Strategy

The first step of the pullback strategy is to search for an ETF or stock with a trend established. After that, keep an eye on the trend until you see an increase in price from the trend. If the trend is upward, the downward price change or pullback could be an entry point for day traders to purchase.

Day traders utilize technical charts to comprehend the direction of a stock. Fidelity suggests looking for an uptrend with at least two significant price increases before the price drop or pullback. If you're trading short, seek out two declining prices within the same row. If the trend reverses completely when you make your purchase, it's not a reason to be concerned because the trend typically persists in the same direction for a while. It is possible to find pullbacks among the stocks with the most gains.

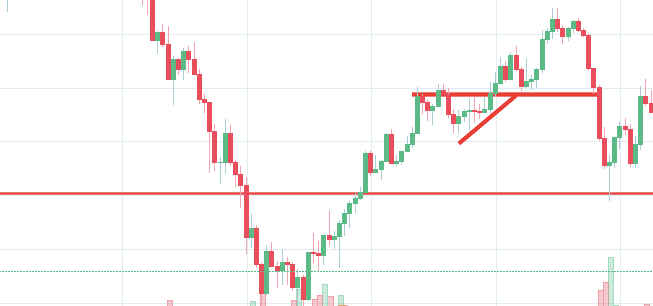

Breakout Trading

A breakout occurs when the stock price rises over the previous price of resistance at the top. It's not as straightforward to look at an image on a chart, noting the resistance and buying following the breakout. It is important to keep track of the amount of trading volume in stocks or the number of shares changing hands.

This is because breakout trades with high volumes tend to last at the current price than breakouts with smaller volumes, as per Fidelity. The breakouts with less volume tend to be more likely to fall to previously resistance-based levels, making it harder to make a profit. In most cases, stocks will decline once they have reached the resistance mark until there's a catalyst that allows for a price increase. Beyond this particular price, there are more sellers than buyers, thus preventing the price from rising even more.

News Trading

You may already be aware that stocks respond quickly in response to events. A poor earnings report could cause the price of a stock to drop. However, a situation similar to the FDA approval of a new drug could make a stock take off. If you keep the latest business stories in mind, day traders could profit from the most popular news reports published daily.

Form W-2: Definition and Working

How To Get Started Investing With Little Money

Buy or Sell Stocks

ETF vs. Index Fund: An Overview

All About the Fractional Investing: Get Started in the Market Without Much Money

All About International Tax Competitiveness Index 2022

Saving For Retirement: When Is It Too Late To Have Nothing Saved For Retirement

Methods to Efficiently Cash Out Your Life Insurance Policy

Unintended Harm: Is Fraud Prevention Hurting Financial Inclusion?